For years, police departments have warned about the "pipeline problem": retirements outpacing hires, academy classes running small, laterals heading to better-paying jurisdictions, and a tight labor market that gives 20-somethings plenty of safer, better-paid alternatives. In 2024–2025, the response hardened into something else: an outright compensation arms race. Cities and states aren't just bumping salaries; they're dangling five-figure signing bonuses, stacking retention stipends, and openly poaching from each other with splashy billboards and road-show recruiting events.

Below is a whirlwind tour of what that looks like on the ground—plus what it means for agencies trying to compete without blowing a hole in their budgets.

From signing bonuses to state-backed checks

Florida set the tone early with a statewide recruitment bonus: newly employed officers get a $5,000 after-tax payment, a program that by August 2025 had cut checks to more than 8,700 recruits (over $58 million total). The state actively markets the program to out-of-state officers, catalyzing relocations.

Washington went a different route: beyond agency-level incentives, the legislature authorized a $15,000 annual longevity bonus for State Patrol troopers with 26+ years of service (through 2029). Meanwhile, the Washington State Patrol started offering $10,000 hiring bonuses to entry cadets and $20,000 for lateral hires—firsts for the agency.

Big-city resets (and the ripple effect)

The NYPD and the city's PBA inked a contract in 2023 that raised the first-year base to $53,790 (plus a neighborhood policing differential), explicitly targeting the early steps where NYPD had fallen behind local competitors. It was as much about optics—"we value rookies"—as dollars.

Out west, Los Angeles approved a multiyear package in 2023 layering raises and bonuses; local reporting pegged the additional cost at at least $384 million over the term, reflecting both wage growth and incentive structures needed to stabilize staffing.

San Francisco has experimented with retention tools, including a ballot-backed approach to delay retirements by paying officers who postpone exiting—projected at $600,000 to $3 million per year depending on uptake. It's a blunt instrument, but in a short-handed market, keeping experienced officers a little longer can be cheaper than losing institutional knowledge and running perpetual academies.

Chicago moved on both wages and stipends. A 2023 agreement included sizable raises and shifted a long-standing retention bonus to a one-time $2,000 payment for all officers; analysis also highlighted new $1,000 annual certification stipends (e.g., EMT, CIT, bike officer) to reward specialized skills.

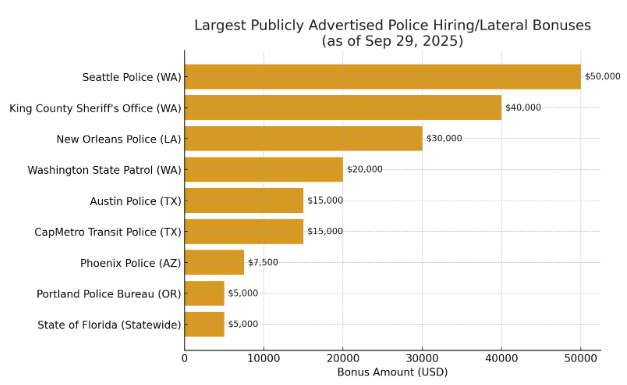

The lateral talent war: $25k, $40k, $50k…

If you want proof that this has become an arms race, look at lateral bonuses.

King County Sheriff's Office (WA) advertises $40,000 sign-on for in-state laterals and $25,000 for out-of-state. That figure has turned heads across the country.

Seattle PD boosted starting pay (first wage increase since 2021) and stacked incentives: $7,500 for new recruits and up to $50,000 for lateral hires—part of a broader 2024–2025 push that coincided with a sixfold hiring surge in early 2025.

Washington State Patrol: $20,000 lateral bonus (plus $10,000 for cadets).

In the Southwest, Phoenix PD touts being the highest-paying agency in Arizona while offering a $7,500 recruit bonus paid in tranches (hire, academy completion, post-probation) and additional language and differential pay stacked on top.

Austin PD has run cycles with $15,000 hiring bonuses and heavy digital recruitment pushes; even the region's transit police (CapMetro) launched with a $15,000 sign-on for officers as the local market stayed hot.

And the competition is no longer polite. Dallas PD has openly courted Houston officers with road-show events near The Woodlands, pitching lateral pay up to $91,007, paid relocation, and internal referral bonuses ($5,000). Houston countered with its own 36.5% pay raise deal, underscoring how quickly compensation packages are escalating—and how intercity poaching is now standard.

"Come make $100,000" recruiting goes mainstream

It isn't just bonuses. Agencies are leading with headline salary numbers. A Wall Street Journal feature chronicled departments blasting "come make $100,000" messages on billboards (Plano, TX, promoted $97,646+), alongside perks like take-home cars and paid workout hours. The subtext: agencies are marketing like tech companies—sell the total rewards and the lifestyle, not just the badge.

You can see that strategy on official pages:

Portland Police Bureau: entry wage $82,000–$84,000 plus a $5,000 hiring bonus, with relocation reimbursement up to $10,000 and laterals in the $95,000–$120,000 range. A 2023 data point the bureau highlights: top-step officers averaged $188,000 with overtime/incentives.

Denver PD: 2025 salary range $71,633–$110,204 and full salary/benefits from day one of the academy, backed by a contract that stair-stepped PO1 pay 4% annually through 2025.

New Orleans floated some of the largest municipal numbers in 2022: a plan with $30,000 in recruit incentives over four years, funded in part by federal relief dollars. Even if the specifics evolve, the message is unmistakable—cash on the table now, not someday.

Do incentives "work"? Early reads and mixed signals

The short answer: sometimes, and it depends on what you measure.

Application volume & time-to-hire. Seattle's package coincided with big application spikes (4,300 apps in 2024, the most since 2013) and a sixfold increase in hires early in 2025, helped by faster screening and online interviews. That suggests incentives plus process improvements move the needle.

Net staffing. A July 2025 PERF pulse survey found sworn staffing among respondents was 0.4% higher than a year earlier, though still 5.2% below 2020 levels. Hiring is above 2019 levels, but departures remain stubborn. In other words: incentives are helping refill the bucket, but the bucket still leaks.

Macro funding signals. Voters and legislatures are still pushing money into recruitment/retention (e.g., Colorado's 2024 Prop 130 concept to steer $350M toward recruiting/training/retention statewide). Even 911 systems are seeking surcharge hikes to deepen staffing benches. The public appetite for "buy capacity" solutions hasn't faded.

The unintended consequences

An arms race rarely comes without trade-offs.

Poaching & churn. When Dallas courts Houston, or counties dangle $40k laterals, you risk zero-sum churn: the region doesn't gain total officers; it reshuffles them. That can undermine neighboring agencies, especially smaller or rural departments that can't match big-city cash.

Pay compression. Big entry bonuses and rapid early-career raises can compress the gap with mid-career personnel, souring morale unless supervisors and specialists see proportional gains. Chicago's one-time across-the-board bonus tried to avoid signaling "only rookies matter," but such fixes are ad hoc.

Budget sustainability. LA's package and SF's retention payouts reflect real fiscal footprints. If crime drops or revenue tightens, councils may balk at making "temporary" incentives permanent—even as recruitment stalls the moment the cash spigot slows.

Equity & optics. Giant checks to laterals can needle homegrown recruits and communities who want investment in training, wellness, supervision, and legitimacy—not only more money for bodies. Meanwhile, statewide programs like Florida's create interstate competition that can politicize hiring.

What winning looks like in 2025

If you're an agency leader, recognize that comp is necessary but insufficient. Departments seeing traction tend to stack four pillars:

1) Market-clear pay + transparent incentives.

Post a clean, simple offer: base pay, step schedule, when bonuses hit, total first-year value. Copy Phoenix's tranche model (hire/academy/probation) to reduce early attrition risk; mirror Seattle's split recruit vs. lateral ladder; publish specialty and education pays clearly.

2) Speed as a benefit.

Seattle's surge coincided with online interviews, accelerated backgrounds, and better marketing. If you can cut weeks off the process, that's a benefit worth more than another $2–3k—especially for Gen Z candidates used to one-click job offers.

3) Retention architecture, not just patches.

Longevity bonuses (WSP), senior certification stipends (Chicago), and retirement-delay programs (SF) are signals that veterans matter. Pair them with modern scheduling (10-hour shifts with three off in Denver), childcare partnerships, housing stipends, and embedded wellness/peer support. Total rewards beats raw cash alone.

4) Purposeful poaching (ethically done).

If you recruit laterals, offer skills credit and fast-track placement into units that use their experience—King County explicitly sells "direct placement" and "choice of work location." That respects the professional, not just the paycheck.

What to track (so you know it's working)

Throwing money without measurement is a fast way to burn trust. Track:

Applicants per opening and qualified applicants per opening (after minimum screening).

Offer-accept rate and time-to-conditional offer; every extra week costs candidates.

Academy yield (graduates/starts) and 1-year retention (hires still active).

Lateral net gain (laterals in minus laterals out).

Cost per successful hire (include marketing, background, bonuses actually paid out).

Diversity funnel health (applications, assessments, offers, academy success by demographic group), then fix bottlenecks (e.g., policy barriers on prior marijuana use).

Where this goes next

Expect several evolutions:

Structured referral markets. Dallas already pays officers to recruit officers; expect referral platforms and interagency "swap markets" to formalize.

State-level co-funding. Florida's checks created momentum. Look for more states to subsidize local incentives during low-unemployment cycles or when major cities can't match suburbs.

Incentives beyond cash. Housing partnerships (especially in high-cost metros), student-loan assistance (mirroring ICE's pitch to officers), and childcare stipends will become the next differentiators.

"Career lattice" marketing. Agencies that sell clear specialty pathways (cyber, forensics, mental-health response, traffic tech) will beat those repeating generic "serve and protect" copy.

Bottom line

Yes—the pay-and-bonus arms race has arrived. It's messy, expensive, and often zero-sum across regions. But for agencies that pair competitive compensation with speed, clarity, career pathways, and real retention design, the new market can be an opportunity, not a crisis. Money will open the door; culture, process, and purpose will keep people in the room.

Examples cited: Florida's statewide $5k bonuses; Washington's $15k longevity bonus and WSP lateral/entry bonuses; NYPD early-career pay boosts; LAPD's costly raises/bonuses package; San Francisco retirement-delay payments; Chicago's one-time bonuses and specialty stipends; Seattle's $7.5k–$50k incentives and hiring surge; King County's $40k lateral bonus; Phoenix's $7.5k recruit bonus and top-of-market positioning; Portland's entry pay/bonuses/relocation; Denver's wage ladder and schedule; Austin's $15k recruit bonus and CapMetro's $15k sign-on; Dallas-Houston lateral tug-of-war; New Orleans' $30k multi-year incentive plan; Plano and others marketing "make $100k" right on the billboard.